Application of a limit Function Of Negative Hyper-geometric Distribution in Option Pricing.

DOI:

https://doi.org/10.24054/bistua.v20i2.1497Keywords:

Negative hyper geometric distribution, wealth equation and optionAbstract

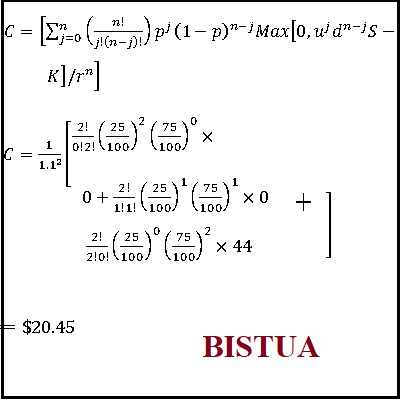

This work introduces limit function of a negative hyper geometric distribution of the form .where and, which is applied in option pricing using wealth equation and some martingale tools. This paper present a simple discrete time model in compares. This work conclude that limit of negative hyper geometric as can be associated with financial terms that can be used to evaluate option values (non dividend) which gives the same numerical with CRR model.

Downloads

References

A. Mehra, S.D Chandra and R. Khemchandari, Financial Mathematics An introduction, Narosa Publishing House, India first edition pp 49-75, 2013.

F.I Cheng and C.I. Alice ,Application of Binomial distribution to evaluate call option (finance) handbook of quantitative finance and risk management availabl e onnline.www.springer.com 2010

J.C Cox, S.A Ross. and M. Rubinstein ,Option pricing: A Simplified Approach journal of financial Economic 7(3):2-34 ,1979.

R. Stockbridge,The discrete Binomial model for option pricing ,Phdprogram in Applied mathematics, available online www.sematicscholar.org. 2008.

K..Teerapabolarn An improved Binomial distribution to approximate the negative hypergeometric distribution, International Journal of pure and applied mathematics 91(1):77-81. 2014

M. B. Zeina, A. Hatip, Neutrosophic random variables, Neutrosophic Sets and Systems, 39, 44-52, 2021.

C. Granados,New results on neutrosophic random variables Neutrosophic Sets and Systems, 47, 286-297, 2021.

C. Granados, J. Sanabria, On independence neutrosophic random variables, Neutrosophic Sets and Systems, 47, 541-557, 2021.

C. Olunkwa, B.O. Osu, C. Granados, Mean variance portfolio selection problem with multiscale stochastic volatility, Prospectiva 20(2)(2022), 1-11

Additional Files

Published

Issue

Section

License

Copyright (c) 2022 © Autores; Licencia Universidad de Pamplona.

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.

© Autores; Licencia Universidad de Pamplona